Give them another reason to choose you.

What if you could provide a benefit to your clients that would save them time and increase the security of the transaction? Plus, it would allow you to see the status of every transaction and run reporting that would make it easier to reconcile your trust account. Seems like a no brainer, right?! We think so too.

TrustFunds allows Law Firms to accept earnest money electronically, rather than by paper check. Agents use TrustFunds to request payments from a buyer directly from an MLS listing, tying the property and payment information together. In addition to the benefits for the agents and buyers, your organization will notice increased efficiency and reduced risk.

Watch David Price, President & CEO of MARIS explain how important a fully integrated electronic earnest money service is to an MLS and the constituents they serve.

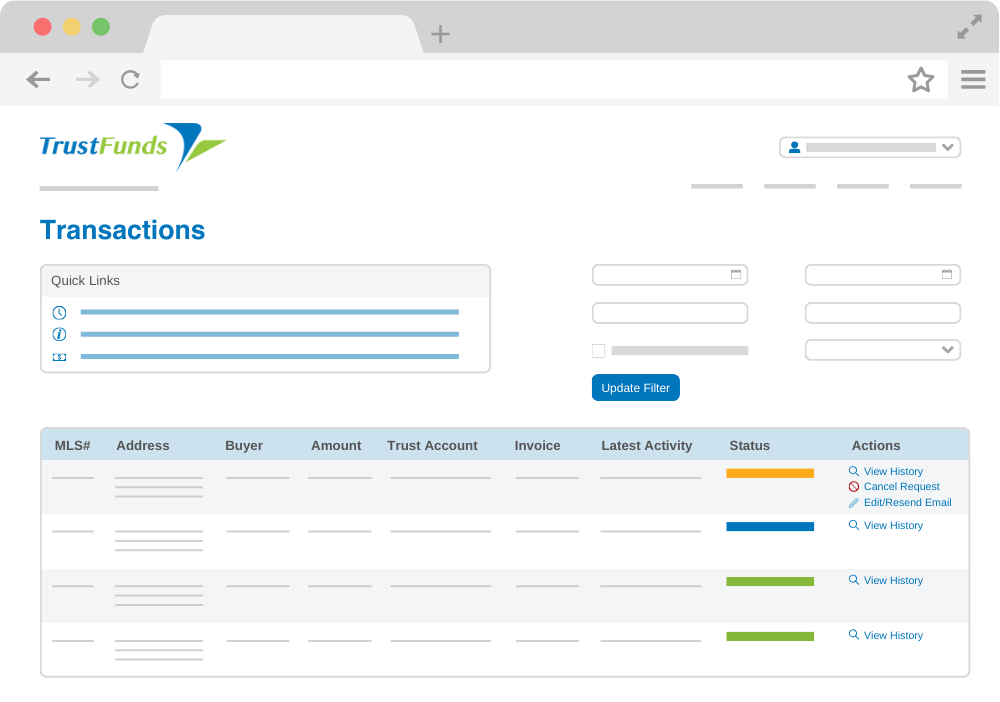

Real-time tracking

TrustFunds provides real time tracking for law firms so you can easily view the status of every earnest money request that has been submitted to your trust account. No more wondering what buyer sent their earnest money, for what property, with which agent. You’ll also be able to run detailed reports that allow you to more easily reconcile your trust account.

Add Value for Agents and Buyers

Give your customers the option of using electronic earnest money. Be the progressive and industry-leading company they want. In addition to the value and security you can offer agents and buyers, you’ll have valuable real-time tracking insight and the ability to run reports making it easy to reconcile your trust account.

Increase Security

Our TrustFunds platform offers layers of digital security far more advanced than the paper check. No more client account numbers or routing information floating around the office or an agent’s car or purse. No more providing your own account information for wire transfers. TrustFunds electronic earnest money process ensures complete security for all parties. Still have security questions?!

Allows buyer to retain control of account information

No photocopies of checks floating around

No images of checks sent through unsecured communications

Account information encrypted at rest and in transit