TrustFunds delivers banking industry payment technology and applies it to the earnest money payment process in real estate transactions.

The Automated Clearing House (ACH) is a payment network that allows electronic submission of payments by directly withdrawing a designated amount of money from a savings or checking account and depositing it into another banking account. According to the National Automated Clearing House Association (NACHA), annually, in the United States, more than 29 billion electronic transactions move $73 trillion from bank to bank using the ACH network. Transactions include direct deposits, government benefits and bill payments such as utility and mortgage payments.

Five reasons why ACH is a preferred payment tool:

- ACH payments are less cumbersome than dealing with paper checks.

- ACH payments are more convenient and much more reliable than paper checks.

- According to the AFP Payments Fraud and Control Report paper checks continue to be the payment method most subjected to fraud in 2021.

- Because ACH is electronic, there is less room for error than in paper checks which require passing along and relying on hand-written information.

- TrustFunds transactions can be fully tracked, letting users know the status for each step in the transaction.

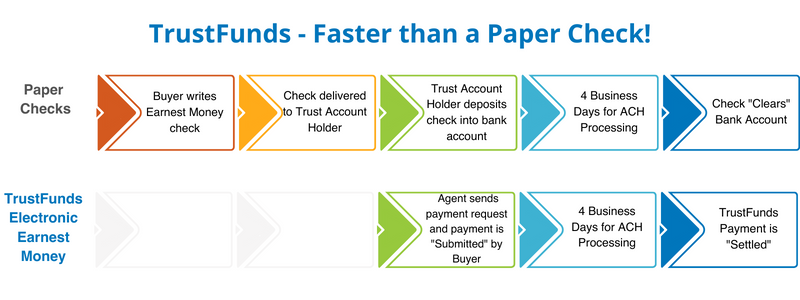

TrustFunds ACH Process vs. a Paper Check

Traditionally, when submitting earnest money, the home buyer turns over a paper check to either their real estate agent for delivery or directly to the broker or title company to deposit the check into its trust account. This process can take days and through it all, the paper check changes hands many times making it difficult or impossible to track. Furthermore, the confidential information, such as account number, on the paper check has the potential for being lost or stolen during the process.

By using TrustFunds, all the guess work of passing around a paper check for earnest money can be eliminated. Instead, the buyer can submit their earnest money payment, using their bank routing and account number, directly online through a secure payment form provided by their real estate agent. Once the transaction is approved, both the buyer and the agent receive confirmation emails. Both listing agent and the buyer’s agent also have access to a receipt and a deposit verification at any time.

Making the earnest money payment electronically by using TrustFunds simplifies the real estate buying process and takes stress away from the buyers, the sellers, and the agents.

Contact us today to get started!