When it comes to making an earnest money payment on a home, security is a top priority for everyone involved. Traditionally, paper checks were used to make earnest money payments, but the real estate sales process has become more digital, and more secure with the use of ACH (Automated Clearing House) payments.

According to the 2022 Association for Financial Professionals (AFP) Payments Fraud and Control Survey, check and wire fraud are the most targeted payment methods. In addition, fraudsters are constantly innovating ways to defraud payment activities.

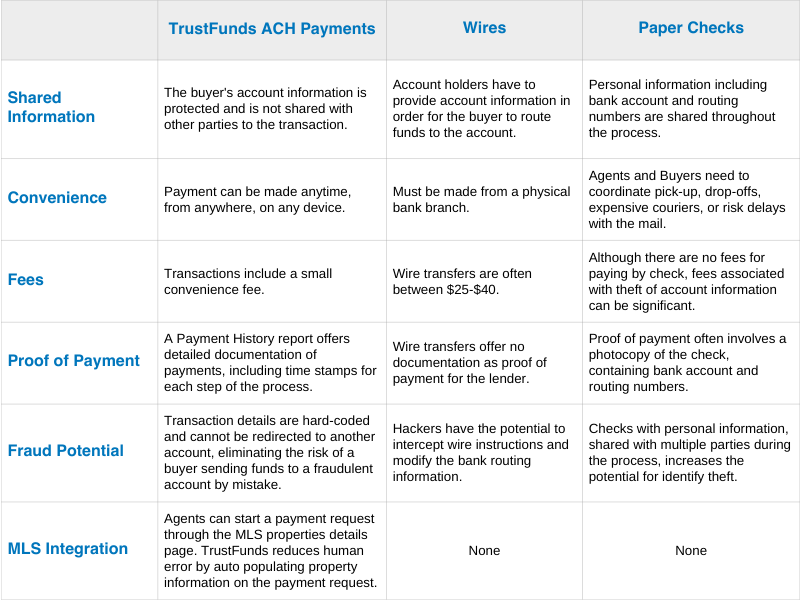

TrustFunds ACH payment model eliminates the need for a paper earnest money check or wire, and provides an earnest money payment that is faster, more secure, and hassle free. Below is an excerpt from our ACH vs. Wires vs. Paper Checks Flyer you can share with your buyers to explain why ACH is really the most secure method of payment.

With Trust Funds, the entire earnest money payment process is completed online in a matter of minutes. The homebuyer no longer needs to fill out a paper check with all their sensitive bank information for all parties to see. No more worrying that a paper check will change hands several times or be copied or scanned. The funds go directly to the designated trust account associated with the transaction.

ACH Benefits for Real Estate Transactions

- Enhanced Security: ACH payment processing (used by TrustFunds) offers enhanced security features such as encryption, multi-factor authentication, and traceability.

- Efficient Streamlined Transactions: ACH payments allow agents to save time and reduce paperwork, making the process more efficient and timely.

- Convenience: ACH payments can be initiated and paid from anywhere. Out-of-town buyers no longer need to worry about wiring or mailing a payment.

- Improved Client Satisfaction: Realtors can offer secure, streamlined, and convenient payment methods through TrustFunds. Efficient transactions help improve client satisfaction and loyalty.

When making an earnest money payment using TrustFunds, the homebuyer is the only person who can see their account information. Their agent simply sends them a secure link and they follow the steps themselves. After the buyer enters their bank account and routing information, they can be reassured each step of the way that the money is being deposited correctly. As soon as the earnest money is deposited, TrustFunds displays an immediate confirmation on screen and delivers an email to both the buyer, their agent, and the listing agent. Both agents can verify and see the status of the deposit at any time after the earnest money payment has been submitted.

Behind the scenes, TrustFunds ensures encrypted security, while verifying the authenticity of all parties involved in a transaction to detect and prevent fraud. We’ve also created a TrustFunds Buyer Education Flyer illustrating our three-step process.

Gone are the days of scanning, mailing, or delivering paper checks and compromising the security of the buyer. TrustFunds delivers a more secure digital experience for everyone involved in the earnest money process.